Demographics of the Survey:

Mean Age of Survey Respondents: 43

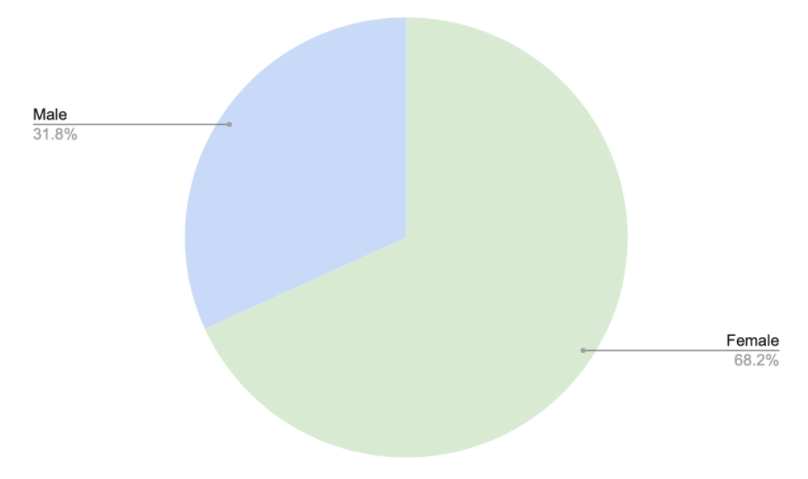

Gender Breakdown of Survey Respondents:

Pre-pandemic State:

Pre-pandemic, how much of your income came from music?

With almost three-quarters of all survey respondents relying on music for 81-100% of their income, fluctuations in the necessity and viability of music-related careers will have substantial impacts on the income stability of these musicians.

Pre-pandemic, what was your gross monthly income?

The median salary of the survey respondents was between $3,000 and $3,999 dollars.

Pre-pandemic, which of these were sources of your music-related income? (Select all that apply.)

75% of survey respondents received part of their income from freelance work, indicating that music gigs are essential to the financial livelihood of classical musicians.

Effects of the Pandemic on Specific Industries:

Which income streams (musical or otherwise) have remained stable for you since the start of COVID closures?

Freelance work was shown to have a 97% decrease in income stability after the onset of the pandemic. Without live audiences, events that require gig music, and the availability of venues, the income created by freelance work has almost disappeared. Reopening processes have been focused on institutions, such as orchestras and ensembles, rather than freelance work.

Orchestral work was shown to have a 88% decrease in income stability after the onset of the pandemic. While larger orchestras may have the funding and support to continue providing their employees with their salaries, many smaller orchestras and community orchestras have struggled to pay their employees without ticket sales and in the absence of a regular show season. An important source of revenue for orchestras is the season pass, which allows devoted concertgoers to purchase a ticket package for the entire season upfront. Without a regular show season, these revenue options are lost. This raises serious questions about whether or not audience members who have had the symphony removed from their routine will attend concerts at the same routine they were previous to the pandemic. Membership in an ensemble has also shown a similar decrease in income stability, at 87%, due to a lack of ticket revenue. Without regular audiences, these organizations find it difficult to provide employees with stable salaries.

Private music lessons were shown to have a 37% decrease in income stability after the onset of the pandemic. While many lesson teachers have switched to Zoom, Skype, FaceTime, or other online platforms to continue teaching their students, 51% of total respondents reported that they experienced a reduction in teaching opportunities. While online options for lessons are more accessible than online options for full concerts, these lessons are often not as rewarding or fulfilling as the in-person alternative. Additionally, due to the financial strain COVID-19 has placed on many families, not as many prospective students are seeking out lessons during this time, which results in fewer teaching opportunities for instructors.

Who was hit the hardest?

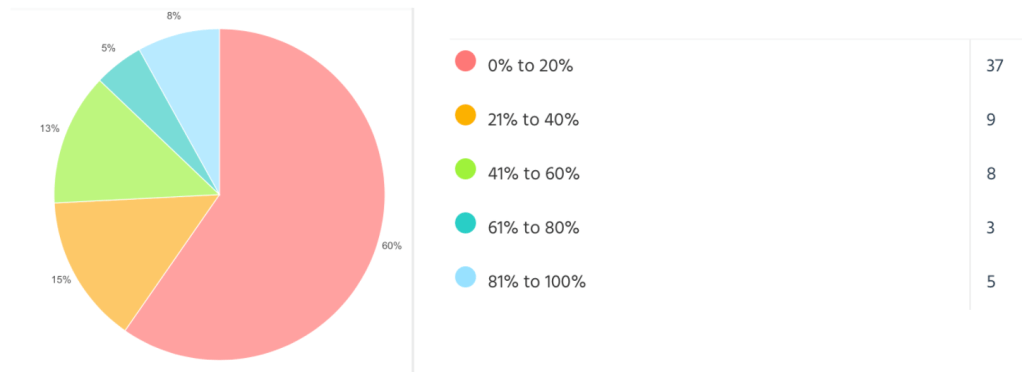

What percentage of income have you lost since the onset of COVID-19?

31% of respondents reported that none of their pre-pandemic income streams remained stable. Most of the respondents that indicated this listed some combination of orchestral musician, member of an ensemble, and freelance work as their stable, pre-pandemic incomes. These are the types of workers that are hit the hardest, because they rely on an audience to receive revenue. Almost every musician in the survey who listed only freelance work as a pre-pandemic music stream of income reported that none of their pre-pandemic income streams remained stable.

All of the respondents that made between $500 and $999 per month and had 81-100% of their income come from music before the onset of the pandemic lost 50% or more of their income during COVID-19, with many indicating that they have lost all of their income. In general, there is a correlation between the percentage of a respondent’s income that came from music and the percentage of income that the respondent lost due to the pandemic. With more income being derived from music, these respondents faced larger losses in their income, particularly those who were involved in only orchestral work, an ensemble, or freelance work.

Losing a source of income: the effects

38% of respondents reported that their health insurance came from their employer, while 8% reported that they were furloughed from a job and 7% reported that they were laid off from a job. In a time where access to health insurance is absolutely essential, some musicians who are losing their careers may be losing access to health insurance as well, leaving them vulnerable to the effects of the pandemic.

Did you or someone you know test positive for COVID-19?

On top of a loss in income stability, musicians may be facing increased financial strain due to hospital bills as well as stress or personal losses caused by the pandemic.

New Income:

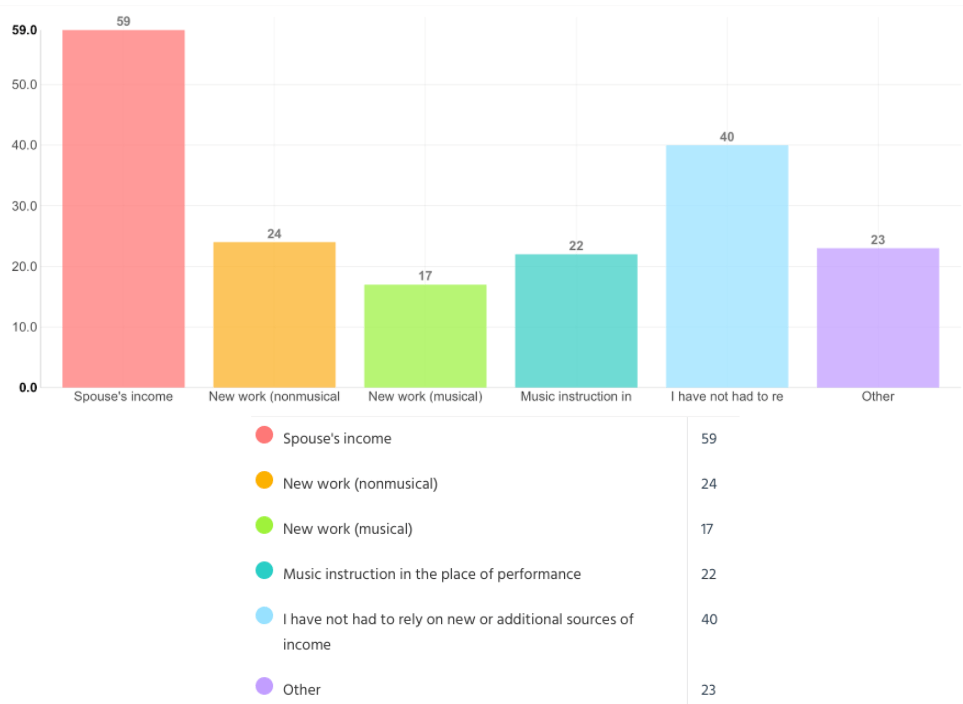

What additional sources of revenue have you had to utilize/rely on during this time?

Virtual Programming: Compensation and Fulfillment

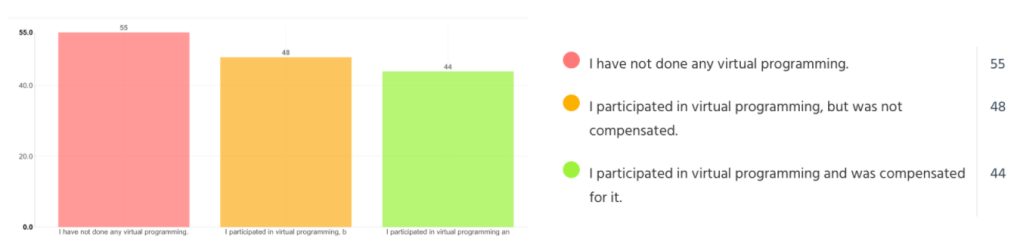

Have you performed in virtual programming? Were you compensated for this virtual programming?

Virtual programming is an opportunity for orchestras and ensembles to put on concerts and shows without the risk of a live audience. These groups had to cancel the remainder of their season before the summer, and virtual programming and live streams can provide a means of starting a new season in the fall. One benefit of virtual programming is that audiences from all over the world can tune in, increasing the accessibility of performances and allowing orchestras to have greater exposure. However, with so many orchestras turning to virtual programming, smaller and less mainstream ensembles may have trouble retaining enough audience members to generate significant revenue, and these ensembles are the most likely to suffer from greater financial ramifications. Only 34% of respondents indicated that at one point, they have participated in virtual programming and were compensated for it, while 37% of respondents indicated that at one point, they have participated in virtual programming and were not compensated for it.

Virtual programming was a popular way to simulate the experience of “playing together”, particularly in the early onset of the pandemic. Music is often seen as the healing in troubled times, and virtual programming was an avenue for musicians to provide that healing. Programs, concerts, and studio recitals that were cancelled may have used virtual programming as a replacement for the loss of that experience. While the advancement of technology has allowed musicians to connect with each other in some ways digitally, these virtual options do not mitigate the financial impact the pandemic has had on the classical music industry.

The Unemployment Benefit System:

A major issue that has prevented many musicians from receiving the financial assistance they require is the ease, or lack thereof, of utilizing the unemployment benefit system.

Many musicians indicate their unfamiliarity with the unemployment benefit system. 47% of survey respondents reported that, on a scale 1 to 10, their familiarity with the unemployment benefit system ranked a 1. The mean response to this question was a 2.75. A lack of experience in receiving unemployment benefits likely proved to be an obstacle for many musicians, who suddenly faced major losses in their income and needed to rely on federal or state assistance for stability.

Many respondents who had applied or filed for unemployment benefits found navigating the unemployment benefit system to be a difficult process. On a question that asked this pool of participants to rank this difficulty on a scale of 1 to 10, the mean response was 5.56. While a substantial pool of participants did not find the process to be overwhelmingly difficult, there can still be changes made to the process to make it easier for those who did.

Since the start of the pandemic, which of the following types of resources have you applied/filed for?

Which of the following types of resources have you received money from?

Unemployment Insurance:

16% of respondents indicated that they filed for unemployment insurance, and 60% of that pool of respondents received money from unemployment insurance. Unemployment insurance policies are determined by state, and the $600 a week derived from the unemployment benefit stimulus package accompanied unemployment insurance.

Several respondents indicated that the $600 a week that accompanied unemployment benefits significantly compensated for lost gig income. This survey was disseminated in August, which was the first month that this payout from the unemployment stimulus package had come to an end, which means the musicians who indicated that unemployment insurance was the most effective source of assistance, were no longer able to rely on it from August forward.

Pandemic Unemployment Assistance:

15% of respondents indicated that they applied for Pandemic Unemployment Assistance, and 74% of that pool of respondents received money from Pandemic Unemployment Assistance. Pandemic Unemployment Assistance is a provision made under the CARES Act, designed to provide up to 39 weeks of unemployment benefits to workers who do not qualify for traditional unemployment insurance, including freelance workers. Respondents who found Pandemic Unemployment Assistance to be the most effective source of aid noted that PUA provided them with the greatest amount of compensation.

Stimulus Checks:

43% of respondents indicated that they received the $1,200 stimulus check, which was provided to all eligible individuals making $75,000 or less and eligible married couples making $150,000 or less. Eligibility was determined by whether or not individuals correctly filed their taxes. Respondents who found the stimulus check to be the most effective source of aid noted that it was little hassle to access the check, and because there was no need to provide any documentation other than evidence of filed taxes, freelance musicians found it to be an easy way to replace lost income.

Paycheck Protection Program:

10% of respondents indicated that they applied for the Paycheck Protection Program, and 50% of that pool of respondents received from the Paycheck Protection Program. The PPP is intended to provide small businesses the compensation they need to keep employees on payroll, and this loan will be forgiven if certain criteria are met. Respondents who found the PPP to be the most effective source of aid emphasized that it allowed them to continue receiving a regular salary, despite the fact that their work was significantly reduced.

Nongovernmental Funds:

6% of respondents indicated that they applied for a nongovernmental fund, and 57% of that pool of respondents received money from a nongovernmental fund. The most common nongovernmental funds that respondents found to be helpful were grants from the American Federation of Musicians.

On a monthly basis, how much money do you receive from the sources you listed above?

What percentage of your pre-pandemic income did this assistance add up to?

How did you hear about these sources of assistance?